The electronic signature has come into our lives as an essential resource for optimising signature processes. Today, its function, as well as its advantages, are two aspects that are internalised in all areas. However, we often have doubts about its specific use in different types of documents and, most importantly, whether its benefits are common to all of them.

For this reason, we clarify what types of documents electronic signatures can be used for and who can sign a document electronically.

What is an electronic signature and who can sign electronically?

The electronic signature is a tool that allows us to sign any electronic document regardless of its type or the nature of the procedures it solves.

Likewise, its benefits, inherent to its nature and independent of the document, are common. This means that the main advantages of electronic signatures, such as agility, increased productivity and reduced costs, among others, are favourable for any type of document or business signature process.

In order to discover the infinite possibilities of the uses of electronic signatures, it is necessary to pay special attention to the figure of the signatory, a task that can be carried out indistinctly by a natural person or by a legal entity. In the following use cases, we will discover that among the types of documents that are most commonly signed, we find several that can be signed by legal persons, whether public or private entities, by means of a digital certificate, as in the case of companies or institutions.

What type of documents can electronic signatures be used for? The 7 most common uses

As we have mentioned, electronic signatures can be used on any type of document. As the list is very extensive, we have selected the types of documents that our clients sign most frequently with electronic signature.

1.- EMPLOYMENT CONTRACTS AND OTHER HUMAN RESOURCES DOCUMENTS

In a global context characterised by major changes in the labour market and new ways of working, the electronic signature is a fundamental tool that allows the human resources area to maintain its activity remotely, signing documents and contracts online in order to continue its activity.

- Employment contracts. Thanks to the electronic signature, both new recruits and existing employees can sign employment contracts in person and remotely, including the remote work contract.

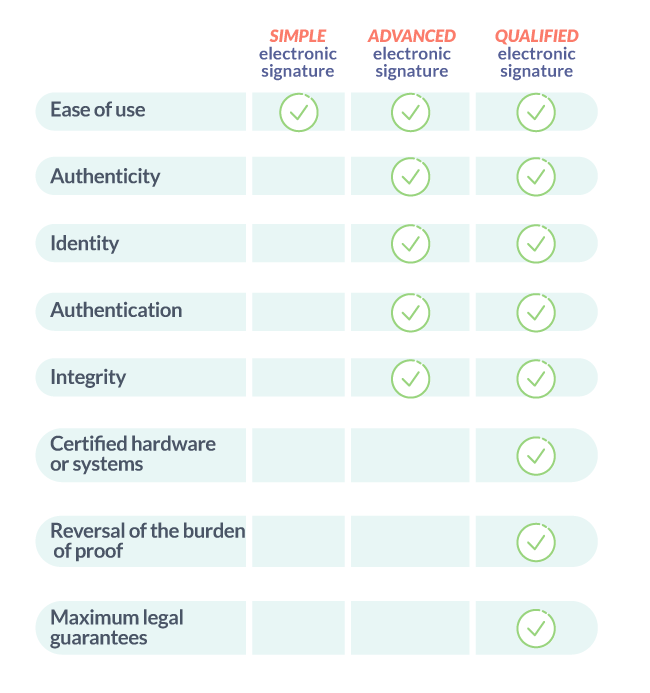

The simplest answer to this question is yes, but it is necessary to clarify that the value and legal effectiveness of electronically signed documents will depend on the type of signature used, with the qualified electronic signature offering the highest level of security, and consequently the maximum legal guarantees.

- Payroll. The payroll or document accrediting the payment of salaries to employees is another type of document that can be signed electronically.

Signing the payroll electronically eliminates the disadvantages of signing on paper, some of which are as costly and unsustainable as the inevitable duplication of copies for the interested parties.

In the specific case of signing payroll, both the worker and the legal representative of the company, responsible for signing the payroll, can use their own qualified digital certificate to sign the document quickly, securely and with maximum guarantees, with the only difference between the two being the type of digital certificate used.

2.- CONTRACTS AND CUSTOMER FORMS

One of the fundamental strategic principles in today's market is to place the customer at the centre. Although there are many reasons why a company decides to digitise its signature processes, one of the main ones is the need to offer a customer-centric signature experience that is maintained over time.

Mainly, companies offer their customers electronic signatures for numerous procedures, some of which are highlighted below:

- Contracts for the purchase/sale of products

- Contracts for the registration of supplies and services

- Service request forms

The new digital customer values immediacy, agility and simplicity, but is not willing to give up security. For this reason, more and more companies are implementing the One-Shot Signature, Uanataca's solution that offers the best signature experience to the customer, allowing them to complete a recruitment quickly and easily.

3.- REAL ESTATE CONTRACTS

In the real estate sector, as in others, we can find different types of contracts with a common characteristic, which is the importance of approach with them properly in order to guarantee compliance by both parties.

The electronic signature is valid for use in any type of real estate contract, from purchase and sale contracts and their different typologies to rental contracts:

- Reservation contracts

- Deposit contracts

- Purchase option contracts

- Lease contracts

Digitalisation has reached real estate, not only the Proptech phenomenon, but also the more traditional models of real estate agencies have managed to adapt and make the most of online operations and the electronic signature as a tool to facilitate change.

4.- SIGNING CONSUMER AND MICROCREDIT LOANS

Now more than ever, the financial industry needs technologically innovative and flexible tools that allow it to adapt to the current market, facilitating its growth and adaptation.

Below, we highlight the main uses of electronic signatures in the financial sector:

- Signing consumer loans and microcredits.

- Contracting financial products

- Opening bank accounts

- Signing transactions and receipts

Not all types of signatures and the different solutions available on the market offer the maximum guarantees needed in the financial sector, which is subject to the rigorous requirements of security compliance and banking regulations. It is therefore important to choose the right type of signature and to have the backing of a Qualified Trust Service Provider such as Uanataca.

5.- INSURANCE POLICIES AND OTHER DOCUMENTS USED IN INSURANCE COMPANIES

Increasingly, it is becoming necessary for insurance companies and insurance brokers to have tools that allow them to carry out their procedures remotely.

Uanataca's electronic signature solutions optimise the signature process throughout the customer's life cycle, whether at the time of contracting, after-sales service or even the renewal of the policy. These are just some of the documents that can be signed electronically in the insurance sector:

- Insurance policies

- SEPA mandates

- Submission of change of address forms

- Claims for non-payment

6.- ELECTRONIC INVOICING

As in the previous case, Uanataca's Automated Signature allows companies to speed up the corporate invoicing signature process.

- Electronic invoicing. In this specific case, the electronic signature guarantees compliance with two essential requirements that all invoices must ensure: authenticity of the invoice's origin as a guarantee of the supplier's identity and that of the invoice issuer, if it is not the same, and the integrity of the invoice's content, guaranteeing that its content has not been modified.

How to choose the type of electronic signature

There is no standard formula, but there is a choice based on the needs and the risk that we are willing to assume. To do this, it is essential to determine what level of security, certainty and probative force the electronic signature applied to each type of document should have.

The following table will help you to detect the type of signature you need:

How can we help you? Contact us and an expert will analyse your case and advise you on the electronic signature service your business needs.