In recent years, Fintech has revolutionised the financial market, even changing the basis of financial services competition and reshaping customer expectations. To a large extent, their success is based on the use of effective technological tools in the new digital ecosystem, such as, for example, the use of electronic signature.

In this post we address the role of the electronic signature in overcoming the different challenges faced by the Fintech sector, as well as the ability to position itself among the main players in the market.

The 4 main challenges facing Fintech

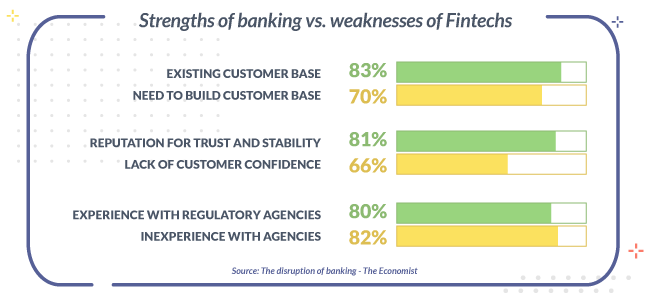

Since their emergence, fintechs and their new business model have changed the way financial services are structured, delivered and consumed. However, the reluctance of customers, especially those less familiar with technology, to switch companies has been underestimated.

In addition to the issues of achieving customer satisfaction and increasing customer trust, there are the legislative challenges facing the Fintech sector.

Differentiation

The Fintech phenomenon has experienced rapid growth in recent years. According to data compiled by Finanso.se, the number of Fintech companies doubled in 2019, reaching more than 21,700 startups worldwide.

The challenge in itself is not that there are an infinite number of Fintechs, but that those that do exist present themselves with a value proposition that differentiates them from both the more traditional banking sector, guaranteeing the viability of the model in the medium term, and from the rest of Fintech.

True disruption in the sector will only be achieved by those who manage to address the customer lifecycle and align the conceptualisation, development and marketing of their offering under a customer centricity strategy. Therefore, as in all service-related work, everything begins and ends with the customer.

Trust

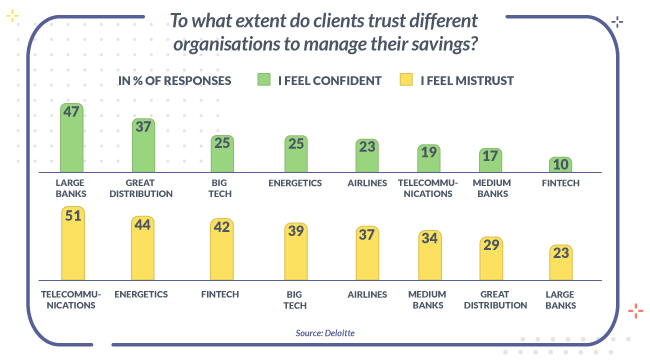

Despite their popularity, Fintechs are at the bottom of the list of financial sector companies that generate the most trust among customers to manage their savings, according to the Open Banking Spain report, prepared by Monitor Deloitte.

The biggest challenge for Fintech companies has to do with trust, with convincing users that their financial services are secure and, once they have become customers, to maintain that status. In this sense, it is vital for companies in the financial sector to have effective tools that allow them to preserve this valuable yet extremely fragile and volatile asset.

Situations that call into question the security of the methods used by companies must be avoided so as not to provoke a crisis of confidence. As we will see below, electronic signatures based on digital certificates are the only reliable solution that offers maximum guarantees to both users and companies.

Agility

In the digital era, the level of consumer demand has increased and immediacy is one of the most appreciated values, especially when it comes to services. Globally, customers feel more empowered when it comes to asking for fast solutions and services, although it is the so-called "Now Generation" that is the most active in demanding agility from companies.

In this sense, the biggest challenge for Fintechs is to provide a smooth, satisfactory and immediate experience, which, in part, is achieved by incorporating the appropriate technological support and tools.

Regulatory framework

One of the great difficulties posed by the Fintech ecosystem is, on the one hand, the heterogeneity of the phenomenon and, on the other, its supranationality. It is absolutely necessary to develop regulation adapted to the needs of the new market players, a complex task due to the disparity of their characteristics.

The aim is to eliminate regulatory uncertainty and avoid the existence of subjects operating outside the regulatory framework through the free adaptation of obsolete regulations. As a result, the security of the use of financial services in the market will be guaranteed, undoubtedly favouring the growth and development of the sector.

The role of electronic signatures in the Fintech sector

In an increasingly technological and digitalised global context, one of the major challenges facing the Fintech sector is to offer quality services adapted to the new environment that meet the expectations of even the most demanding users. In short, it is a question of presenting them with a different, agile, secure and reliable alternative for managing their finances.

In this field, the electronic signature becomes a key element to develop the value proposition of the Fintech industry. Both the cutting-edge technology of Uanataca's electronic signature solutions and the support of the eIDAS Regulation on electronic identification and trust services for electronic transactions, favour the achievement of the main aspects that define the Fintech business model: 100% online financial products, flexible structures and agile methodologies, a customer-centric approach, as well as a structure with reduced costs.

HOW TO ACHIEVE DIFFERENTIATION THROUGH CUSTOMER CENTRIC SIGNATURE PROCESSES

The Fintech sector is experiencing upward growth and, consequently, competition is increasing. The success or failure of the company will depend, to a large extent, on its ability to develop and offer a value proposition that allows it to differentiate itself from the rest.

The fact of being an industry based on new technologies is a common characteristic, not a differential value, and it is necessary to design a customer-centric strategy in which the customer is the centre of the business.

One-Shot Signature is the only advanced electronic signature solution that allows the digitalisation of signature processes to be developed under a customer centric approach, orienting the overall experience of the signature process towards the customer.

QUALIFIED ELECTRONIC SIGNATURES BASED ON DIGITAL CERTIFICATES, THE MOST SECURE

As we mentioned at the beginning of this article, trust is one of the assets most valued by Fintechs and a key factor in their success.

It is almost inevitable that when a sector begins to develop and grow, failures are made, and there are even cases of lack of transparency and honesty. All these situations, added to the initial distrust of any new financial service and the reputational crises that affect the financial sector, become an almost insurmountable challenge if the right tools are not available.

Qualified electronic signatures based on digital certificates issued by Qualified Trust Service Providers such as Uanataca are the only ones that offer real guarantees of authenticity, integrity and non-repudiation.

The qualified electronic signature, comparable to a handwritten signature, as well as the security of Uanataca's solutions and the protection of its integrated and audited services under the EIDAS regulation, are determining factors when it comes to arousing the client's confidence.

GREATER AGILITY AND CONVENIENCE: MAIN ADVANTAGES OF UANATACA'S SOLUTIONS ADAPTED TO FINTECH

100% online financial products are one of the aspects most valued by users. Customers turn to the convenience of the Internet to gain immediacy, as well as to avoid unnecessary travel.

For this reason, Fintech companies must implement agile and intuitive solutions in all their signature processes with customers. One-Shot Signature is an intuitive tool that is extremely easy to use, with no need for prior knowledge, nor is it necessary to install any type of programme or application.

THE EIDAS REGULATION, A GUARANTEE IN THE DIGITAL CONTRACTING OF FINANCIAL SERVICES

While it is true that the implementation of the PSD2 regulation has favoured the growth of the Fintech industry, it remains a priority to establish a regulatory framework adapted to the needs of the market.

In the meantime, Fintech companies can take advantage of the common basis provided by the eIDAS Regulation in ensuring a secure environment in which digital identity and trust services for electronic transactions are regulated in the European Single Market.

In this sense, the Fintech sector finds a great ally in the European digital regulation, as this is the only way to ensure the necessary guarantees in the digital contracting of financial services and for online banking transactions.

Therefore, eIDAS and the use of related tools such as Uanataca's electronic signature services provide the necessary technical and legal security in the Fintech sector.

📢 ¿ Do you want to discover the advantages of One-Shot Signature or Bulk Signature for Fintech? Request a free personalized demo.