Today, only 1 in 2 insurance companies are profitable. As McKinsey & Company's Global Insurance Report 2022 has just revealed, industry profits have fallen 15% since 2019, a decline that began 15 years ago and continues unabated.

This is mainly due to persistently low interest rates, pricing pressures and slowing customer demand, especially in the life insurance sector in Europe and the US. Alongside this, the influence of Covid-19 has increased the hegemony of large companies, so that the top 10% of companies in the sector account for 80% of economic profits.

Creating value, unlocking latent demand and improving the customer experience are the main challenges facing the sector. In this post we break down the value levers that the consultancy firm recommends for the renewal of the sector and the recovery of economic levels prior to the pandemic.

Context of the insurance industry: low productivity, new players and the continuing battle for the customer

Even before 2020, the insurance industry faced significant challenges. The last two years have been a rollercoaster ride, with recession and the most peculiar recovery in living memory. Now, addressing the challenges to mitigate the downturn in the sector has become a priority:

• Structural factors challenging industry growth. There are three factors working against revenue growth: low interest rates putting pressure on spread-based businesses such as life insurance; pricing pressures driven by tariff transparency, new digital players and lower-priced supply; and stagnant demand, with slow growth in mature markets.

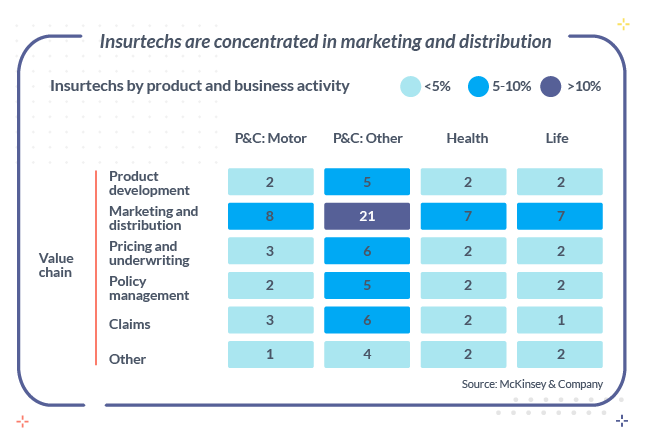

• The fight for the customer. Insurtechs are driving the digitalisation of the industry and driving business model change. Investments in insurtech worldwide have grown by 1,360% in 17 years (from $1 billion in 2004 to $14.6 billion in 2021).

Among their priorities is to address pain points in their customer relationships through digitally enhanced experiences. To achieve this, more than 40% of insurtechs focus on the marketing and distribution segments of the insurance chain.

• Preference for intermediaries. Over the past few years, insurance brokers have secured their position of strength. On the one hand, brokers' shareholder returns are higher than with other segments, and private equity firms are investing. On the other hand, their business model, with few assets but more personalised, captivates the consumer.

• Low productivity. Overall, productivity improvements have been low. Between 2014 and 2019, expense ratios declined for only 45% of global general insurance companies. For many, ratios did not move or even increased.

"The industry is on the verge of a paradigm shift and insurers face fundamental strategic questions. Anticipating and preparing for emerging trends is more important than ever," said Rui Neves, senior partner at McKinsey.

6 steps to reverse the trend

On the other hand, the McKinsey & Company report lists a number of actions that management teams need to take to reverse the trend. Below is a selection of what we consider to be the most immediate actions:

1.- MODERNISE CORE TECHNOLOGY PLATFORMS AND DIGITISE PROCESSES

From 2012 to 2020, the average percentage of technological operating costs increased by 36% (in general insurance) and 10% (in life insurance). The explanation is to be found in the increasing rise of digitalisation.

Digital transformation is putting both processes and traditional systems to the test. Many insurers are therefore considering replacing core systems with technology platforms that meet the requirements of the digital age. The challenge of digitalisation is to complete it without costing more than expected and to do so in the short/medium term.

Electronic signature for insurers

Facilitates insurance contracting

Uanataca's e-signature solutions enable insurance companies to offer a fast and secure signing experience for any type of transaction: taking out insurance, renewing a policy, signing SEPA mandates and many more.

Any of these activities can now be carried out remotely over the Internet, without the need to print, sign, scan the required documentation, and email it back to the institution.

Without the electronic signature, no transaction can be completed 100% digitally.

Our solutions are easy to integrate via API, legally compliant and flexible: no fixed fees or subscriptions. In addition, they enable digital onboarding with qualified electronic signature: agile contracting for the customer, secure for the company.

2.- INTRODUCING ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG) CONSIDERATIONS

ESG criteria are increasingly taken into account when investing in a company. For investors, they have become a strategic priority involving significant risks and business opportunities. However, while many insurers have started to consider ESG criteria when shaping their investment portfolios, there are still not enough assets that meet these criteria. With climate risk on the rise, insurers have an opportunity to address risk mitigation:

· Rebalance their portfolios

· Helping organisations mitigate climate change

· Create innovative products to address climate change

· Review investment strategies

3.- REGAINING RELEVANCE THROUGH PRODUCT INNOVATION AND HEDGING NEW RISKS

The world is changing rapidly and new risks are constantly being created. Some of them, despite the seriousness of their consequences, have remained uninsured. Others that already existed but were considered insignificant have now come to the fore, such as those related to data exposure and cyber-attacks, climate change or pandemics such as the current one.

New risks and old risks that have become more relevant require a reorientation of your asset portfolio with innovative products. In short, it is a great opportunity to reverse the trend.

4.- IMPROVING THE CUSTOMER EXPERIENCE

The policyholder experience has become a lever that generates differential value and raises levels of consideration. Therefore, improving the customer experience has become a strategic objective for the insurance industry.

In short, it is about offering experiences aligned with the new digital habits of the consumer.

5.- ADDRESSING THE PRODUCTIVITY IMPERATIVE

The continued low interest environment has hit insurance in mature markets hard. The industry as a whole is in the red and cost-cutting exercises have not been effective: boosting performance and increasing productivity is key.

Insurers can begin the process of improving productivity by establishing the trajectory and full performance potential of the business across the value chain, including sales and distribution, product development, operations, technology and corporate functions. These actions involve major structural changes for which insurers must be prepared.

6.- ENGAGE WITH ECOSYSTEMS AND INSURTECH

All industries, including insurance, are undergoing a paradigm shift. Ecosystems of connected partners will enable insurers to evolve, with access to services and functionalities to support more targeted data processing and improved decision making, benefiting the customer.

Insurtechs aspire to play a role in this recomposition of the value chain. McKinsey research suggests that ecosystems could comprise $60 trillion in revenues by 2030.

In addition to the above, there are other value levers in the face of today's challenges: reimagining culture, diversity and ways of working to attract and retain talent; increasing the impact of data and analytics; and, finally, developing new business for the digital age. Read more: McKinsey & Company's Global Insurance Report 2022.

In conclusion, in recent years, insurers have focused on four areas: productivity, presence in the fastest-growing markets, economies of scale and the benefits of diversification. But none of these approaches has been sufficient.

To avoid an industry downturn, there is an urgent need to create value by moving from a diversified, generalist business to a sharper, digital, specialised business model.