The rise of teleworking, the increase in online shopping and, in general, the change in the way companies relate to their ecosystem, has led to the digitisation of most business processes. In the transformation of the system, from a physical form to the digital plane, we find the digitisation of the signing of contracts.

Be sure to read this post to discover the keys to the successful digitisation of contractual processes in your company.

Digitisation, the present of companies

According to Wikipedia, digitisation is the action and effect of digitising, where digitising means recording data in digital form.

Very simply, we can say that the digitisation of companies is the process of transforming a business organisation through the use of technology, digital tools and technological resources to optimise work processes.

Therefore, digitising a company is a deeper process than designing your own website to sell your products or offer your services. There is no doubt that it is a complex global process, but it is also fundamental and necessary.

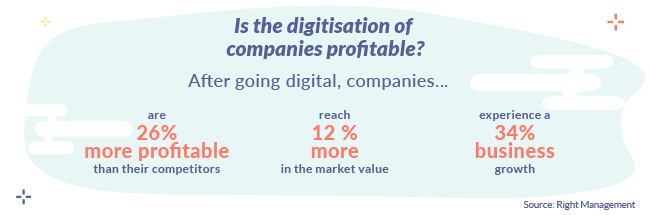

The digitisation of companies, far from being a project for the future, is already a reality. There are several reasons why companies should prioritise the digitisation of their processes. Mainly because of the convenience for both employees and customers, who can interact in a much simpler and more immediate way. The customer can access services from their own home at any time. For the worker, the possibility of being able to carry out their tasks from home is a great advantage.

Why digitise contract processes?

The answer to the question of why companies should digitise contractual processes lies in the efficiency of the processes.

Digitisation makes it possible to optimise different processes in the company, including the signing of fundamental documents, such as contracts formalised between the company and any agent involved in its activity.

Generally speaking, signing a contract on paper means, for example, that all parties are physically present at the place of signature. In addition, it is necessary to give a hard copy to each party, with the risk of loss of the document and the subsequent necessary investment of time and expense to retrieve an original copy. This meant that signing the contract became more complicated as the contract increased in number of parties, obligations and rights, consideration, and so on.

In contrast, in a digital contract, all parties can negotiate, sign and execute electronic contracts in real time. In addition, the printing of documents is significantly reduced, as each party can have the digital contract.

All these advantages of digitisation over paper-based signature processes translate into improved efficiency and productivity by eliminating costs, reducing execution times, minimising human error and achieving greater agility.

Digitisation of contracts: keys to its success

THE CUSTOMER

It is necessary to evaluate the new needs of your customers, both current and potential, and look for the best way to satisfy them. To do this, the digitisation of contracts in the company must always put the customer at the centre. This customer centric culture also extends to employees and other collaborators.

Therefore, when digitising processes, we must always ask ourselves how we are going to improve the customer and user experience: can they formalise the contract in less time, do we prevent them from having to travel, do they get a satisfactory experience? And above all, what can we offer that makes us stand out from the competition?

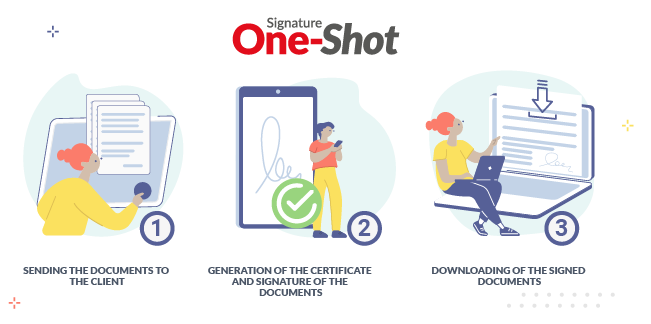

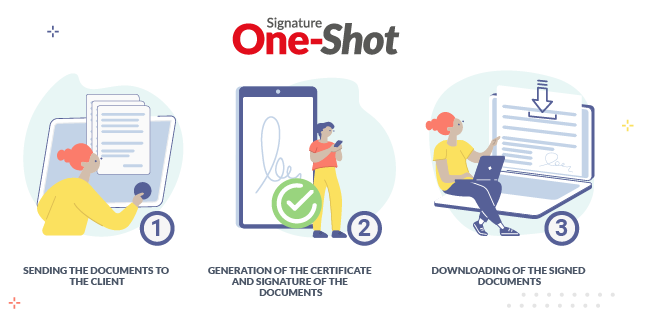

Uanataca's One-Shot Signature ensures that the signing experience is simple and intuitive, allowing you to sign a contract online and instantly, without having to travel and with maximum guarantees. Customers and other users will be able to sign with a digital certificate without the need to have one beforehand.

END-TO-END DIGITISATION

To a large extent, success in the digitisation of contracts lies in approaching the process from an end-to-end perspective. Broadly speaking, the development and implementation of the system should be based on three fundamental principles: rethinking from the user's perspective, simplifying and standardising the process and, finally, aiming for a common, cross-cutting structure.

THINKING IN TERMS OF CONTINUOUS IMPROVEMENT

Digitalisation is an open process, in which new elements are continuously added. In a company, when adopting digitalisation as a long-term strategy, it is necessary to be willing to constantly question what you do, how you do it and how you can improve it.

Therefore, it is important that you have scalable and flexible technological tools. To ensure continuity, they must be able to adapt to the different types of contractual relationships that are often common in business and to the safeguards required in each case.

The importance of the electronic signature in the formalisation of a contract

The signature of a contractual document accredits, confirms and affirms the provision of consent and the approval of the entire content of the document by those who sign it. Its importance lies in the particularity of its function, which is to prevent the parties from raising or raising questions about the non-existence or invalidity of the contract or of the parties to it.

Given its importance, when determining which type of signature is the most appropriate, we must take into account its guarantees and the risk we are willing to assume:

Types of electronic signature

The eIDAS Regulation distinguishes 3 types of electronic signature, ranging from the most basic electronic signature and the one that provides the least security to the user, to the most legally secure and legally backed up level of qualified electronic signature.

Simple electronic signature: this is the most basic, and cannot be compared to a handwritten signature.

Advanced electronic signature: this type of signature is at an intermediate level of security and cannot be compared to a handwritten signature.

Qualified electronic signature: of the three types of signature recognised by the eIDAS regulation, it is the only one equivalent to a handwritten signature. In summary, we can stress that unlike simple electronic signatures, the qualified electronic signature is the only one that reverses the burden of proof and is not repudiatory. It is also the only electronic signature that by itself endows the signed document with integrity, including any type of contract.

In certain contracts, due to their characteristics and their implications for business activity, it is advisable to use a qualified electronic signature, since there is a need to provide legal certainty to the parties so that the signatories are unequivocally identified, the signatories cannot deny that they have signed and that the document is the original and has not been modified.

END-TO-END DIGITISATION

To a large extent, success in the digitisation of contracts lies in approaching the process from an end-to-end perspective. Broadly speaking, the development and implementation of the system should be based on three fundamental principles: rethinking from the user's perspective, simplifying and standardising the process and, finally, aiming for a common, cross-cutting structure.

THINKING IN TERMS OF CONTINUOUS IMPROVEMENT

Digitalisation is an open process, in which new elements are continuously added. In a company, when adopting digitalisation as a long-term strategy, it is necessary to be willing to constantly question what you do, how you do it and how you can improve it.

Therefore, it is important that you have scalable and flexible technological tools. To ensure continuity, they must be able to adapt to the different types of contractual relationships that are often common in business and to the safeguards required in each case.

The importance of the electronic signature in the formalisation of a contract

The signature of a contractual document accredits, confirms and affirms the provision of consent and the approval of the entire content of the document by those who sign it. Its importance lies in the particularity of its function, which is to prevent the parties from raising or raising questions about the non-existence or invalidity of the contract or of the parties to it.

Given its importance, when determining which type of signature is the most appropriate, we must take into account its guarantees and the risk we are willing to assume:

Types of electronic signature

The eIDAS Regulation distinguishes 3 types of electronic signature, ranging from the most basic electronic signature and the one that provides the least security to the user, to the most legally secure and legally backed up level of qualified electronic signature.

Simple electronic signature: this is the most basic, and cannot be compared to a handwritten signature.

Advanced electronic signature: this type of signature is at an intermediate level of security and cannot be compared to a handwritten signature.

Qualified electronic signature: of the three types of signature recognised by the eIDAS regulation, it is the only one equivalent to a handwritten signature. In summary, we can stress that unlike simple electronic signatures, the qualified electronic signature is the only one that reverses the burden of proof and is not repudiatory. It is also the only electronic signature that by itself endows the signed document with integrity, including any type of contract.

📢In certain contracts, due to their characteristics and their implications for business activity, it is advisable to use a qualified electronic signature, since there is a need to provide legal certainty to the parties so that the signatories are unequivocally identified, the signatories cannot deny that they have signed and that the document is the original and has not been modified.

Cases of use of electronic signatures

- Employment contracts

- Deposit contracts

- Lease contracts

- Consumer credit and microcredit contracts

- Contracts for financial products

- Contracts for the registration of mobile phone lines and other services

And in general, with the electronic signature it is possible to sign any type of common business contract of a commercial, collaboration, guarantee, insurance, loan and credit type.

In conclusion, digitalisation can be carried out in any type of company. Although each sector is undertaking this transformation at a different pace, digitisation is more of an obligation than an option.

Certainly, we still generally believe that digitalisation is linked to B2C businesses because of the customer-centric approach, but if we treat the company's departments as customers and suppliers, we naturally become a B2C business.

In both B2C and B2B companies, the digitisation of signature processes offers cross-departmental benefits. Its benefits are not limited to the signing of contracts, as they can be extended to any type of document, from payroll signatures to opening bank accounts.

>> Start the digital transformation of your business today.

If you need advice on any aspect related to electronic signatures,contact us. A trusted service specialist will offer you the best solution ad