The payment industry is in a transitional phase, where the global pandemic has accelerated the trend of digitization, which, although it has been a long time in coming, has now become a priority. In the current unpredictable scenario, the payments industry is betting on the development of new solutions that anticipate and respond to the needs of a market eager for innovation.

In this post, we address the Covid-19 pandemic, innovation in means of payment and PSD2 regulations as catalysts for the transformation of the sector and the advance of digital payments.

The unstoppable march towards a cashless society

The transformation of payment ecosystems in the last decade has been remarkable, mainly driven by the entry of new players and the emergence of new customer-centric, more innovative and technology-intensive business models.

Undoubtedly, the Covid-19 pandemic has accelerated the transition to a cashless society, with new consumption habits in relation to cash, a stagnant payment method that is beginning to decline due to the adoption of preventive behaviors in the face of contagion. In contrast, digital means of payment have increased.

This change is evident in the progressive advance of the digital payments market, particularly in Europe, with growth set to continue over the next few years. According to a report by sijoitusrahastot, Europe ranks as the second fastest-growing country for digital payments, behind only Asia. In 2020, the volume of digital payments in the old continent reached the important figure of 192.5 billion euros, with a predicted annual increase until 2024 of 13.4%.

7 trends that will define the future of payments

Companies are accelerating their digitalization plans to adapt to the demands and new payment habits of the population, and as we will see below, incorporating new technologies that have become trends that will mark the future of payments.

Customer-centric

As the payments ecosystem grows, the customer experience becomes the main differentiating value. Through digital technology, providers can offer the customer a complete digital experience at all stages of the customer lifecycle.

Open banking

This growing trend allows banks, with the customer's authorization, to share their information with third parties, including means of payment. The PSD2 directive, which will be discussed later, allows, for example, providers to offer the service of initiating electronic payments between different accounts via an interface that bridges the two.

Contactless

Internationally, contactless payment is one of the most widely used means of payment and will continue to grow in 2021. In the case of Europe, and following the measure extending the payment limit for contactless systems without the need to enter the card PIN, Visa processed a total of 500 million contactless payments, a hitherto unattainable figure.

Wearables

The use of technological gadgets or devices used as accessories is positioned as one of the major payment trends for 2021.

Tokenization

This payment system, which makes it possible to convert the customer's card numbers into a numerical code, a token, provides security and confidentiality to transactions, helping to popularize this system.

Artificial intelligence

This tool applied to online payment services improves the user experience, one of the key elements in the customer-centric strategy, prevents fraud, and improves feedback, opening new doors to the development of personalized services.

Face to pay

This year, this method of payment through facial recognition will become popular. The tool allows customers to synchronize their bank details through an app, authorizing payment through facial recognition.

Trends in means of payment, the focus of the second session of Paris Fintech Forum

At the second session of the Paris Fintech Forum, the exclusive European event for finance and Fintech where Uanataca will be present as an official exhibitor, the evolution and trends in means of payment will be the main focus.

This new event will bring together leading international speakers to explore trends in the payment industry and address the expectations of the players involved. Among others, relevant figures from the financial sector will share the stage, such as Michael Miebach, CEO at Mastercard, Gilles Grapinet, Chairman at Worldline, or Lizzie Chapman, CEO at ZestMoney.

PSD2, the new directive to increase payment security in Europe

There are three European regulations that provide a favorable scenario for achieving the new banking model so desired by the customer, with more personalized, open and inclusive banking: the eIDAS Regulation, the General Data Protection Regulation (GDPR) and the new PSD2 Directive.

These legislative instruments represent a breakthrough for the financial industry, complementing each other perfectly in achieving a suitable environment for electronic payments. On this occasion, we will deal in detail with PSD2 (Payment Services Directive 2) as it is exclusively oriented towards improving security in electronic payments and fraud protection by means of strong authentication (SCA).

PSD2 is the European Directive that regulates payment services in Europe (e.g. transfers, direct debits, card payments...), it is an update to the first Directive of 2007 "PSD1", which established the creation of the single market for payments in the European Union. The new directive is aimed at both consumers and merchants, promoting a more integrated payments market, reinforcing the security of transactions, providing greater transparency and efficiency by eliminating intermediaries.

The revised Payment Services Directive also allows third-party providers (TPPs) to intervene in payments, promoting what is known as open banking.

Although PSD2 dates back to 2015, member states had until 2018 to transpose it. However, in the case of countries such as Spain, given the complexity of its uniform implementation in all EU member countries, the banking authority granted a moratorium until January 1, 2021.

The main advantages offered by PSD2, which benefit both customers and merchants, are the speeding up of payments and the increase in the conversion rate in online commerce, the prohibition of surcharges for paying by card, as well as the reinforcement of trust and security in electronic payments.

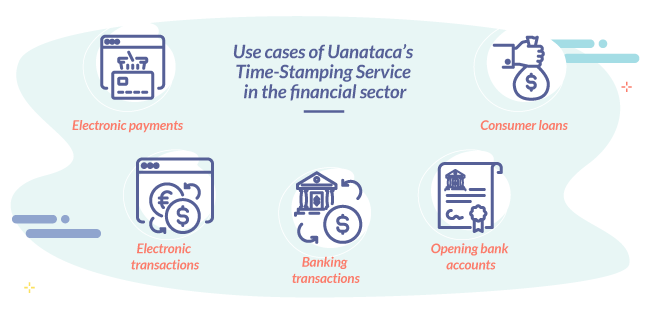

Time-stamping in electronic payment systems: the importance of when

One of the main objectives of PSD2 is to guarantee the security of payments and improve consumer guarantees, but there are also other mechanisms that reinforce the protection of online payments. Electronic payments, like any other transaction that requires the certainty that it has been carried out at an exact time, can benefit from the high value that time stamping provides by proving, by means of date and time, its existence and integrity.

📢 What is time-stamping?. It is a mechanism that allows proving that a series of electronic data, such as an online payment, have existed and have not been altered from a specific moment in time.

Unlike the other systems available on the market that affect the time element of electronic payment, qualified time-stamping is the one that offers the greatest legal guarantees. The eIDAS regulation, the common legal framework for trust services in the EU, particularly regulates the qualified electronic time stamp, attributing its issuance exclusively to a qualified electronic time stamp service provider, a recognized and audited figure that acts by providing trust to the time-stamping service.

The Uanataca qualified time-stamping service is the solution designed for specific cases in this sector, such as the electronic sealing of transactions, certificates and electronic proofs. In the same way, it is perfectly adapted to the needs and particularities to date and validate the time of receipt of an electronic transaction, to certify banking transactions or to establish the date of issue in an electronic invoice, opening bank accounts, consumer credits, credit conditions, among others.